Glossary

Logout

©Copyright Arcturus 2022, All Rights Reserved.

7

Terms & Conditions

|

|

|

|

Security & Privacy

Contact

COMPETITIVE BENCHMARKING

|Introduction

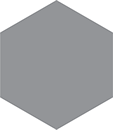

Understanding the ‘Competitor’ is key success factor in the formulation of your product strategy. Market intelligence once again plays an important part in answering fundamental questions. The following diagram indicates the type of questions that require intelligence data in order for you to develop a competitive strategy.

The purpose of competitive benchmarking is to ascertain the following information:

- Present competitors: Who are they; what are their competing products, market shares, strategies and geographical coverage; assess their main strengths and weaknesses.

- Future competitors: Will new competitors enter the market; how are existing competitors expected to behave in future?

- Competing services: Are new services competing with or substituting for the facilities provided by this kind of product or system? What will happen in the future?

Competitor benchmarking provides a genuine measure of market competitiveness and should be undertaken on a regular basis. The following questions need to be answered from the following points of view.

Present Competitors:

Answer the following questions regarding each competitor;

1. Who are they?

2. What are their competing products?

3. Market shares?

4. Strategies and Geographical coverage?

5. Their Strengths and Weaknesses.

6. Their Product Position.

Use the Competitive Benchmarking / Decision Making Model to visually profile each competitor...

The following Video is a walk through of the Decision Analysis Business Model - This particular example is to decide upon the best product from a choice of 5 Potato Peeler’s. Obviously the attributes of measurement can be changed to meet the requirement of the application - Up to 5 Products can be added to this model.

Future Competitors:

1. Will new competitors enter the market?

2. How are existing competitors expected to behave?

Having answered the above questions conduct a SWOT (Strengths, Weakness, Opportunities and Threats) Analysis for each competitor (from their perspective). The above analysis will provide us with the necessary support information to make quality strategic decisions.

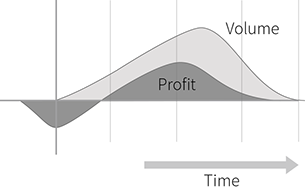

Product Life Cycle

BCG Matrix Position

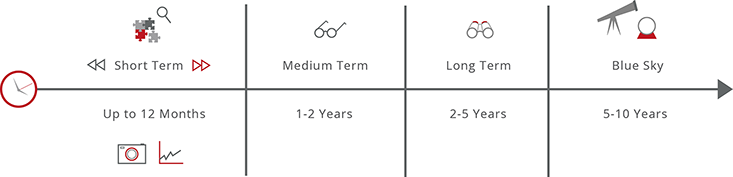

Timeframe:

The following diagram represents various timeframes associated with competitive benchmarking analysis.

|Method

Introduction:

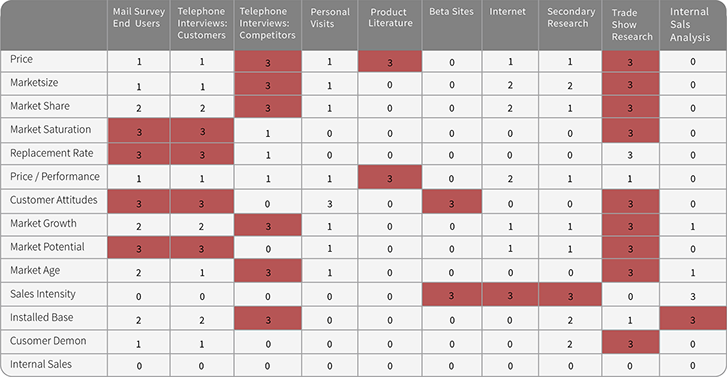

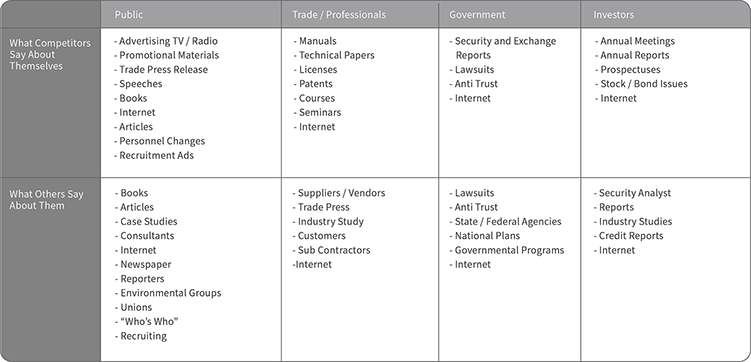

The following table is an example of ‘where and how’ to get gather basic market intelligence information. The table itself is not a substitute for a specific research intelligence project and as such should only be used as a way to gather ballpark market intelligence data. You must decide how much time you can allow for this activity. As a guide, 80% of market information can be found within a very short period of time (<2weeks) the remaining 20% will take substantially longer (6 – 12 months).

The table as shown is generic (example only) and will almost certainly require slight modifications to meet your specific product area.

The table is available as a business model entitled ‘Market Research and Intelligence’

Competitive Benchmarking Dashboard:

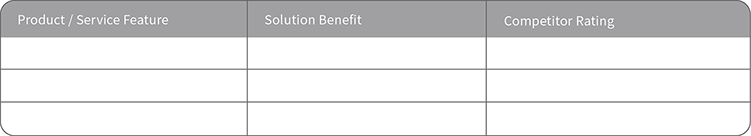

Features and Benefit Analysis:

What are the key features and related benefits of the (proposed) product?

Produce a table (as above) of ‘key features’ Vs ‘benefits’ of the product. Key features represent the ‘unique selling points’ (USP’s) and as such provide genuine product differentiation in the target market. It is important not to be tempted to put features which in turn are no better than the competition.

Competitor Intelligence:

|Who Should Attend...

Key / Definition:

Monitor: Oversees the overall process, required to provide top level strategic objectives as required, performs a management role.

Core: Defines the ‘Core’ team headed (chaired) by the Product Manager required to attend the workshop in alignment with the ‘Product Phase’. Membership is mandatory.

Sec. Mem: Secondary Membership defines an ‘on‐standby’ membership requirement and will depend upon the subject area, phase alignment and the project status. Membership is managed by the Product Manager.

On Req: On Request membership defines a membership that is managed by the Product Manager.

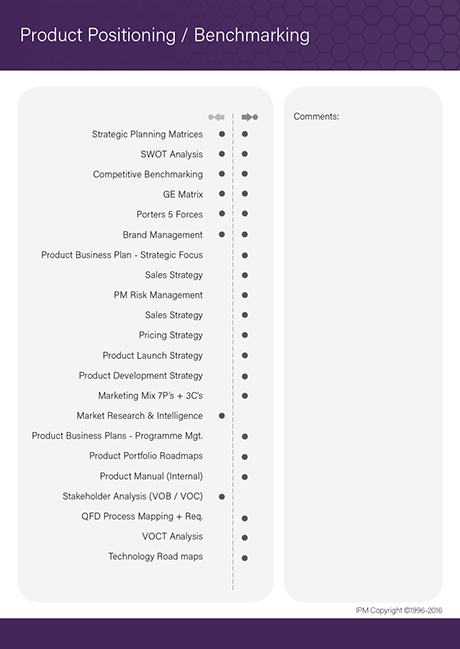

|Related Procedures

The following interrelationship maps indicate; suggested content from other models/processes which may have influence or an effect on the analysis of the title process. The left-hand column indicates information or impact from the named process and the left-hand column indicates on completion of the process/analysis it may have an influence or effect on the listed processes.

Note: A complete set (professional quality) of PMM interrelationship cards are available to purchase - please contact us for further details.

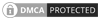

|Strategic Business Models, Workshop Tools & Professional Resources

The IPM practitioner series, is a definitive and integrated training programme for management professionals operating in the Product Management arena. So whether you’re the Managing Director, Product Director, Product Manager or a member of the Multidisciplinary Team we are confident that you will find this particular training series to be one of the best available and an invaluable asset to both you and your company.

PMM - Professional Support

Interactive Business Models

Perceptual Position Mapping

- Benchmarking 20+20 Attributes

Perceptual Position Mapping -

Emotional Benefit & Rational

Performance (EBRP)

Decision Analysis - Benchmarking 10 Attributes

More