Glossary

Logout

©Copyright Arcturus 2022, All Rights Reserved.

7

Terms & Conditions

|

|

|

|

Security & Privacy

Contact

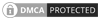

PRODUCT VIABILITY MODELLING

|Introduction - Product Viability Modelling and Financial Planning

Investment and Return

Product Design and Development is not an optional general overhead expense but an investment which can yield some of the highest rates of return.

Financial policies which treat design as an expense rather than an investment with a measurable return have discouraged some very profitable design projects.

Strategy and Planning

The planning of R&D activity and spending must be an integral part of overall business strategy and planning.

Increased and maintained profit

Investment in design should be planned and justified not only in terms of the incremental profits it can generate, but also in terms of the historical profits it can help to maintain. This is because margins can fall rapidly as products age and demand for them decreases.

The foundation for future expenditure

If added value is designed into a product, the higher profit margins will support continued spending on design and efficient production.

Identifying and justifying design spending

Design costs should be defined and calculated in a way which clearly reveals the benefits of such expenditure, as well as how it performs as an investment. Accountants should become actively involved in defining and justifying design expenditure. To reflect this, the terms 'cost accountant' and 'cost accounting' should be replaced by 'profitability accountant' and 'product profitability analysis'.

Product profitability

Distinguishing design spending from other spending and justifying the level of expenditure demand careful analysis and calculation of product profitability. There are different approaches to the estimate of 'product profit' and 'product cost', so it is crucial to establish a consistent and suitable one for your business with your accountant.

Gross profit margins

Some accounting systems are based on achieving a gross margin after deducting all variable costs, but this implies that fixed costs exist — and no costs are fixed forever. One of two main approaches can be used, depending on the scale of the project. Usually, it is best to define the gross margin level as the level achieved after charging all costs, such as direct materials, direct labour and certain others, which are dedicated (can be specifically allocated) to a particular project or product. This certainly applies to incremental product improvements. However, if you are considering a major, long-term, stand-alone project, such as a completely new product, it is important to calculate the full costs very carefully and include all shared costs and fixed overheads in your calculations.

Added value

Added value is a simple but useful performance monitor and should always form part of product profitability analysis. In this context added value is best regarded as the difference between sales value and the cost of all bought-in goods and services which can be directly related to the product.

Net product profit

Business plans, annual budgets and monthly management accounts need to show which products provide the most profit and to track products' profit history. Estimates of net profit attributable to specific products or groups of products will therefore be required. All non-dedicated costs or all non-variable costs (depending on which of the two main approaches have been used to calculate gross profit) will have to be apportioned.

Capitalisation and amortisation

Capitalisation and amortisation must be handled correctly if a product profitability calculation which properly reflects return on design investment is to be reached. Where product development costs are substantial, it is inappropriate to recover design and development overheads alongside manufacturing overheads as a percentage on top of manufacturing direct labour or as part of a manufacturing hourly rate. It is better to capitalise product development costs against projects first and then amortise them against the sale of relevant products. This means agreeing a clear basis for amortisation with Marketing. It is also better to underestimate the quantity of sales over which to amortise, and to achieve higher unit amortisation on early sales while the product can still command a premium price.

Some projects may well under-amortise, so you will need to over-amortise on others. Some companies account for the whole of their design and development costs in this way; others only amortise the dedicated or variable cost elements.

Because design is a continuous process, it is usual to write off costs against current earnings in accordance with Statement of Standard Accounting Practice, but this obscures the benefits which should ultimately arise from expenditure on design. The SSAP does provide for capitalisation as well, but few companies have taken advantage of this. Taking expenditure to the profit and loss account in the year it is incurred may be conventionally prudent in statutory financial statements for external purposes. However, there is no reason why internal accounting, reporting and control should not treat design costs as an investment to be amortised over the profitable lives of products, as these lives normally far exceed a single accounting year. In some businesses, similar logic should be applied to market development costs.

Design & Development costs

Design & Development costs is classified a business 'Fixed cost' and must be monitored and apportioned in a way which highlights their benefits. This is an essential part of obtaining the appropriate product profitability calculation. Design department costs can usefully be classified under the following headings:

- Resource / Labour costs

- space costs

- equipment costs

- Feasibility Costs

- Jigs and Fixtures

- Consultants / Third Party Costs.

Labour costs

People who work on specific projects should be booked to weekly time-sheets (activity based costing) so that labour costs can be allocated to relevant projects. Staff sometimes regard this as bureaucratic, but control of labour resources is a vital ingredient of project management. Supervisory staff can often complete the time records required, particularly if they are reminded not to exceed the levels of accuracy or detail required for project management purposes.

Only management and staff who spend little of their time working directly on individual projects should be charged to an overhead account. When in doubt, charge 'direct' to projects and clamp down on anyone suggesting that time recording is related to status. It is now thought inappropriate to deal with some payroll costs as fixed and other payroll costs as variable. The objective is to estimate the share of total payroll costs (whether direct or indirect) that should be attributed to a product or project.

The hourly design rate

A common method of apportioning design overheads to individual projects is to add a percentage mark-up to 'direct salaries', but most people find it more helpful to use the hourly or daily rate system. This is more compatible with planning and allows comparison with subcontracting alternatives. Total design department costs should therefore be divided by direct hours (those specifically chargeable to projects) to arrive at an hourly design rate. Keep the system as simple as possible, and use only one hourly rate unless there are very large salary differences or unless very expensive specialist facilities (for example wind-tunnel testing or technical computing) are used in differing proportions.

Variable costs

Variable costs, such as bought-in materials and subcontract work, should be charged directly to relevant projects.

Central service charges

Central service charges should be carefully distinguished and, where necessary, challenged. The design function should accept service charges only where these can be clearly justified and where the costs concerned would be avoidable if the design activity did not exist.

Manufacturing, sales and other overheads

The product profitability calculation can now be completed by taking all other overheads into account, as well as the direct costs of manufacturing. Once appropriate amortisation levies have been deducted to cover product and market development costs, charges will need to be made for overheads (including depreciation) incurred in manufacturing, sales and support. Activity-based costing methods should be used to ensure that charges reflect the actual support provided by each particular function to the product in question. Always remember that it is better to be approximately right than precisely wrong. Ensure that all costs are apportioned and that there is no significant unrecoverable balance of overheads, except on capacity under-utilisation.

Fixed manufacturing overheads

The case for investment in product design has often been concealed or threatened by poor apportionment of fixed manufacturing overheads. These can represent a large part of the total costs and yet are often beyond the influence of the designer if the company is not prepared to alter or update its facilities continuously in response to new designs and technologies. Innovative design can eventually help to bring about large fixed overhead reductions.

When the factory is short of work, special care must be taken in apportioning fixed manufacturing overheads (such as depreciation and rent) to products. It is then customary to allocate these as if the factory were working to capacity, and to create a separate loss variance attributable to under-used capacity and not to products. Unfortunately, the definition of 'normal' in this context is arbitrary and subject to competitive pressures. Some companies avoid the problem by charging only variable manufacturing costs against, products to arrive at a gross margin or 'contribution' towards profit and the recovery of fixed overheads. This approach can be dangerous unless accompanied by target recovery rates agreed with your accountant, and by constant review of the actual level of overhead costs to keep them down.

The final calculation

By using the above approach, finance will arrive at realistic calculations of product profitability and cash-flow (before interest and tax). This method will help to avoid the common tendency to under-cost (and sometimes consequently under-price) complex, low-volume products. Remember that these 'management profit' calculations have been adjusted to allow for the capitalisation and amortisation of product development (and possibly also market development) project costs. To this extent `management profit' will normally differ from 'financial profit' used for statutory and fiscal purposes.

SUMMARY

When product development costs are significant, make sure they are identified and charged accurately against products. This will usually involve capitalisation against projects, followed by amortisation against sales. Without accurate identification and charging of costs your product profitability analyses will be seriously flawed and you will be unable to evaluate or appreciate the benefit of your design spending.

|Product Manager / Project Manager - Financial Planning Responsibilities

The Product Manager responsibilities include the following:

- authorise all resources committed to the project. (Expenditure is committed when purchase orders and manufacturing requisitions are signed.)

- estimate and plan, then regularly review labour, material and other variable costs both committed and already incurred

- use the information on outstanding cost commitments when re-estimating future expenditure and completed project cost.

- Project status reports

- Regular status reports prepared by or for the project manager should include the following:

- current status (where are we now?)

- problems foreseen/action taken/help needed

- variances to date:

- time (+/- weeks)

- project expenditure (£ +/-)

- capital expenditure (£ +/-)

- estimated variances to completion (as above)

- revisions to marketing forecasts (if any).

- Reviewing serious overruns

- Projects which achieve milestone targets are usually the financially successful ones. Late projects usually are not. Time is money, and a serious time overrun invariably signals a similar cost overrun. Its cause is usually inadequate resources in the initial stages of the project. In such circumstances a review team, similar to the project screening team should investigate whether or not to continue the project, by asking:

- have the major problems been resolved?

- will there be an acceptable, marketable product that generates an acceptable gross margin?

- can the revised launch date and profits forecast be accepted?

- is the product strategically important to the company?

If the answers are predominantly 'yes', consider the merits of continuing on the basis of a revised cost, time, revenue and profit projection, as if a new project were about to start. Compare this with the alternative of cancelling the project. Historical (`sunk') costs have no direct relevance in deciding whether or not to continue. If the answers are predominantly `no', the design should either be substantially changed to make it acceptable or the project terminated without recrimination.

Project evaluation

After product launch, when a sales pattern has been established, a peer review should examine whether objectives have been met and what lessons can be learned for the future from:

• marketing: customer acceptance

• manufacturing: unit cost of production

• project management: planning, communications, control of expenditure and time-scale

• actual technical performance compared with brief

• finance: likely return on investment.

Financial monitoring should continue after product launch and the project team structure should be retained to facilitate the development of modifications to product and process in the light of feedback from Production, Marketing and After-Sales Service. This process must be encouraged, because it can be highly cost-effective.

In summary, the management accounting system must provide adequate information at the right time for realistic forecasting and review of projects. Progress must be continuously measured by means of project status reports, and serious time and cost overruns must be investigated. Once a sales pattern has emerged the project should be reviewed and lessons learned for the future. Continuous improvement should be encouraged after product launch.

|Product Viability Modelling

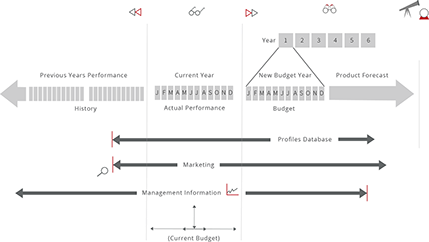

The Product Viability Model is a ‘ready to use’ business application module for the Microsoft® Excel spreadsheet. This versatile product is a member of IPM’s Business Solution Series, it will help you to determine the commercial viability of a new product before committing to actual development. IPM has harnessed the powerful features available in Microsoft® Excel to give you one of the most comprehensive business modelling products available today.

Financial ratios, interactive scenario analysis and discounted cash-flow projections up to 6 years can all be produced and analysed with ease. Management presentations can be undertaken with absolute confidence and “what if” scenarios can be dealt with in real time. The Product Viability Model will have immense value to anyone with a professional interest in product business planning. Company Directors, Marketing Managers, Product Managers, Development Managers and Consultants will find this an invaluable business tool. The generic nature of this application makes it eminently suitable for a wide range of business fields.

The Product Viability Model is extremely versatile and easy to use. Colour coded templates and navigational maps provide the user with a modern, ergonomic interface. On line, help is provided throughout the product in the form of cell notes that can be viewed automatically in Excel (when the mouse cursor is placed over a cell note indicator).

Financial Modelling

- Financial Scenario Analysis - (what if....) on 10+ variables and critical success factors

- Direct and Indirect Sales entry

- Fixed and variable Costs entry

- Discounted Cash-flow analysis

- Ratio analysis - 12 pre-set and 4 user configurable

- Assets and liabilities

...simply enter your market / financial data into the entry fields and the model will produce a comprehensive set of cash-flow / discounted cash-flow predictions, a full summary of results to include ratios, together with the opportunity to check best and worst case scenarios (made up of 10 variables) simply by moving control sliders. Understanding when payback will take place and the predicted value of cash-flow, profit, and the associated surplus is calculated in minutes. Quite simply one of the most powerful financial analysis tools available.

The model is an invaluable tool for anyone involved with 'new product development' (particularly hardware type products but not exclusively), 'product management' and 'market development'. The innovation 'entrepreneur' will also find this tool immensely useful.

Product Viability Model - Elements

The Product Viability Model is made up of the following elements

- Revenue

- Variable Costs

- Fixed Costs

- Assets and Liabilities

- Scenario - What if

- Results and Summary

- Revenue

Sales (Direct) :

Sales (Direct) is the sales revenue forecast for direct sales (sales achieved via your own sales force directly to the end user). Data is entered in the form of volume and unit selling price.

Sales (OEM / Dealer)

Sales (OEM / Dealer) is the sales revenue forecast for indirect sales (sales achieved via a dealer or distribution network). Data is entered in the form of volume and unit selling price.

Variable Costs

Variable Costs (Direct)

Variable Costs (Direct) are, the variable costs associated with distributing the product through your own distribution channel and are entered in the form of a % of the unit selling price. Variable costs are broken down into three elements.

Distribution / selling costs

Warranty Costs

Freight/Duty/Local Costs

Variable Costs (OEM / Dealer)

Variable Costs (OEM / Dealer) are, the variable costs associated with distributing the product through a dealer channel and are entered in the form of a % of the unit selling price. Variable costs are broken down into three elements.

Distribution / selling costs

Warranty Costs

Freight/Duty/Local Costs

Manufacturing Cost

Manufacturing Cost is the per unit cost of the product. Data is entered in the form of a High volume cost/unit, a Low volume cost/unit, together with a unit price break.

Fixed Costs

Fixed Costs (Direct)

Fixed Costs (Direct) are, the fixed costs associated with distributing the product through your own distribution channel. Fixed costs are broken down into the following areas.

- Marketing Communications

- Sales

- After sales

- Indirect Costs

Each of the above is subdivided into further elements and can be re-labeled if required.

Fixed Costs (OEM / Direct)

Fixed costs (OEM / Direct) are the fixed costs associated with distributing the product through a dealer distribution channel. Fixed costs are broken down into the following areas.

- Marketing Communications

- Sales

- After sales

- Indirect Costs

Each of the above areas is subdivided into further elements and can be re-labeled if required.

Development Costs

Development Costs are the costs associated with developing the product. Product development costs are broken down into two categories :

- Development Costs

- Capital Costs

- Each of the above areas is subdivided into further elements and can be relabelled if required.

Capital Costs entered into this field are not subject to depreciation and consequently, have not been used in the cash-flow calculation. However, costs are transferred to the summary sheets.

Assets and Liabilities

Capital Expenditure

Capital Expenditure is part of Development Costs. Capital Costs entered into this field are not subject to depreciation and consequently, have not been used in the cash-flow calculation. However, costs are transferred to the summary sheets.

Manufacturing Stock

Manufacturing stock is entered as a % of manufacturing cost. Increasing the rotational stock will lead to a theoretical improvement in delivery time scales. Manufacturing stock can also be entered as a fixed value if required.

Assets and Liabilities

Creditor and Debtor days can be set independently of each other and are used to calculate a Working Capital requirement. Development costs are added to the Working Capital requirement to provide a Total Working Capital requirement per year. Liquidity and Current ratios are also calculated on a per year basis.

Information regarding headcount (summation of Fixed headcount) and associated costs have been included in the assets and liabilities summary.

Scenarios (What if…..)

Sensitivity

This field enables you to run ‘what if’... scenarios and comprises of two totally independent scenario fields that are benchmarked to the baseline of the plan. Percentage variances are entered for each of the 10 ‘what if’... categories and a Line graph, situated adjacent to the entry field, immediately displays the effect. The user can select the graph in view (Profit, Revenue, Cash-flow, Discounted cash-flow) from this field.

What if... Categories :

- Income (Direct)

- Income (OEM / Dealer)

- Variable Costs (Direct)

- Variable Costs (OEM / Dealer)

- Fixed Costs (Direct)

- Fixed Costs (OEM / Dealer)

- Development

- Capital Costs

- Manufacturing Costs

- Manufacturing Stock

- Results and Summary

Summary

Three sets of summary results are provided.

Plan Summary (or Baseline)

Scenario 1 summary (parameter variance in the Sensitivity field)

Scenario 2 summary (parameter variance in the Sensitivity field)

Each summary produced is identical in structure and as such will help when comparing results.

NPV ratio and development recovery % are situated on the Plan Summary sheet.

Ratios

12 key financial ratios provide a performance overview of the plan (baseline) together with scenarios’ 1 and 2. A mission (or Goal) can be entered for each of the factors / ratios.

- Profit (%Sales)

- Manufacturing cost (%Sales)

- Total Fixed & Var. Costs (%Sales)

- Development recovery (%Sales)

- Development Cost

- Development Cost (%Sales)

- Capital Cost

- Direct Sales (%Sales)

- Indirect Sales (%Sales)

- Marketing Communication (%Sales)

- After Sales (%Sales)

- Discounted Cash Flow Surplus after 6 years

The 12 pre-defined ratios are complemented by four user-defined ratio fields, allowing the user to define specific ratios if required.

Graphs

This field summarises in a graphical form results from the model. The following graphs are presented :

- Profit: Line Graph

- Revenue: Line Graph

- Cumulative Cash Flow : Line Graph

- Cumulative Discounted Cash Flow: Line Graph

- Cost Breakdown: Pie Chart

A top-level financial summary is provided in the form of :

- Total Revenue

- Variable Costs

- Gross Profit

- Profit

| Walk through video

|Related Procedures

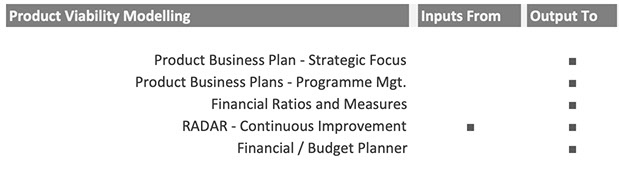

The following interrelationship maps indicate; suggested content from other models/processes which may have influence or an effect on the analysis of the title process. The left-hand column indicates information or impact from the named process and the left-hand column indicates on completion of the process/analysis it may have an influence or effect on the listed processes.

Note: A complete set (professional quality) of PMM interrelationship cards are available to purchase - please contact us for further details.

|Strategic Business Models, Workshop Tools & Professional Resources

The IPM practitioner series, is a definitive and integrated training programme for management professionals operating in the Product Management arena. So whether you’re the Managing Director, Product Director, Product Manager or a member of the Multidisciplinary Team we are confident that you will find this particular training series to be one of the best available and an invaluable asset to both you and your company.

PMM - Professional Support

Interactive Business Models

More